With No Income Limits, More Vouchers Go to NC Wealthy

After income limits were dropped for the 2024-25 school year, more private schools in wealthy counties are receiving taxpayer-funded tuition voucher payments.

RALEIGH, NC, UNITED STATES, March 4, 2025 /EINPresswire.com/ -- The 2024-25 school year is the first time North Carolina’s taxpayer-funded private school voucher program (i.e., Opportunity Scholarship voucher program) has no income limits on who can apply. Even the wealthiest families—with incomes greater than $260,000/year—can now receive a $3,360 voucher (per child) to help offset tuition at a private school. Families with lower incomes can receive up to $7,460 per child.As a result, 2024 applications hit a record high, with 55% coming from families too wealthy to have qualified in previous years.

And private schools with few—if any—students who previously qualified for vouchers lost no time in taking advantage of the opportunity.

The biggest taxpayer-funded windfall this year goes to Metrolina Christian Academy Indian Trail (1) in Union County. The school is receiving $3.7 million more this year than it did last year when income limits were in place. In 2024-25, taxpayers are funding $4.6 million in tuition payments at Metrolina Christian Academy.

The top 5 beneficiaries of the new rules can all boast a one-year gain of at least $2.6 million more in taxpayer-funded tuition in 2024-25. The 2024-25 high school tuition for these schools ranges from $11,221 (Metrolina Christian) to $21,720 (Covenant Day):

-Metrolina Christian Academy Indian Trail, Union

-North Raleigh Christian Academy, Wake

-Covenant Day School Matthews, Mecklenburg

-Gaston Christian School, Gaston

-Carmel Christian School Matthews, Mecklenburg

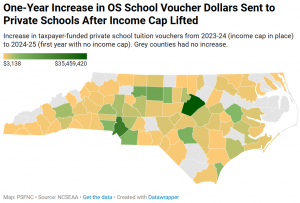

Statewide trends show that the voucher increases are highly concentrated in urban and suburban areas, further straining resources for rural areas that already struggle to fund their public schools. Tax dollars that could have been allocated to teacher raises or other programs that benefit public education and our communities are instead going to unaccountable private schools.

Even the private schools in 22 of the state’s 100 counties received no benefit from the income cap removal. These private schools—all located in rural counties—are likely serving a higher proportion of lower-income students and were already maximizing their voucher enrollments. The voucher expansion has accelerated the trend of rural counties subsidizing private schools in primarily wealthy, urban counties. See an interactive map of voucher funding changes here.

Private schools in affluent Wake County gained the most. In 2023-24, taxpayers funded $13.9 million in private school tuition in Wake. This year, taxpayers have already spent $49.4 million, a one-year increase of $35.5 million.

For example, Grace Christian School (2) in Raleigh received $145,731 in 2023-24, but with the income caps removed, this year the school has received $2,555,995 state dollars. This represents a $2.4 million one-year windfall. Grace Christian’s high school tuition in 2024-25 is $13,370. The school’s strict admissions requirements include providing transcripts (with a minimum GPA), test scores, a student/family admissions interview, and letters of recommendation.

Cardinal Gibbons (3), a Catholic school in Raleigh that charges $13,550/year for Catholic parish affiliated students and $18,235/year for non-Catholic affiliated students also received a taxpayer-funded windfall. The school went from $240,204 in voucher tuition payments last year to $2,037,423 this year, a $1.8 million one-year increase.

The windfall for private schools in Wake County bumped it to the highest overall recipient of taxpayer-funded vouchers, knocking Cumberland County to second. Since the OS voucher program launched in 2014, Wake County private schools have received $100.1 million in private school tuition payments. The top voucher recipients are all urban/suburban counties:

Wake County: $100,132,841

Cumberland: $97,393,602

Mecklenburg County: $76,369,404

Guilford: $66,930,575

Forsyth: $43,336,470

Together, private schools in these top five counties have received $384,162,892 in taxpayer-funded tuition payments since the program launched. See an interactive map of total dollars sent to private schools by county here.

The top recipient of taxpayer-funded vouchers in 2024-25 is Grace Christian School (4) in Lee County. It is getting $5.1 million in taxpayer-funded tuition payments this year alone. That’s a $2.0 million increase from last year. 2024-25. Their 2024-25 high school tuition is $17,900.

Public Schools First NC compiled data from NCSEAA (5) on OS voucher schools by school and county. You can find it here. Look up your county and the schools within your county and share the information!

1. Metrolina Christian Academy Indian Trail: https://www.metrolinachristian.org/

2. Grace Christian School, Raleigh, Wake County: https://www.gracechristian.net/

3. Cardinal Gibbons: https://www.cghsnc.org/

4. Grace Christian School, Sanford, Lee County: https://www.gracechristiansanford.com/

5. NCSEAA: https://k12.ncseaa.edu/

Heather Koons

Public Schools First NC

+1 919-749-6184

email us here

Visit us on social media:

Facebook

LinkedIn

Instagram

YouTube

TikTok

Other

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release